A 20-Year-Old’s View on the Market

In 2019, I started to invest in the market. At the time, I was a junior in high school. As a 17-year- old, I quickly understood the importance of investing to grow long-term wealth and have my money work for me. During my internship at Derbend Asset Management this summer, however, I gained a new perspective on just what it takes for an investor to achieve those types of returns. In short: have a plan, stick to the plan, and understand that historically the market is a permanent uptrend with temporary interruptions.

For reference, over the last 30 years the S&P 500 returned an average of 9.89% annually. Undoubtedly, investments can underperform in some years or outperform in others. I have experienced that in the three years since I began investing. In contrast to the S&P 500 returns, the average savings account pays 0.07% annually. I may be a young investor, but I can certainly understand the power a 10% compounding return has over a 0.07% return, especially over a meaningful period of time.

It is important in my opinion to understand the terminology the media uses when the stock market experiences a downturn: pullbacks, corrections, and bear markets. But what do they mean? A pull back is a short term 5-10% downturn in the market. A correction is a downturn in the market that is greater than 10%, but less than 20%. A bear market is a pullback over 20%. In late June of 2022, during the heart of my internship, we had entered a bear market hovering around -21% on the S&P 500 YTD. As I am writing this on August 19th, 2022, the S&P 500 is in correction at -11.15%. Quite a ride in such a short period of time.

My Personal Experience with Volatility

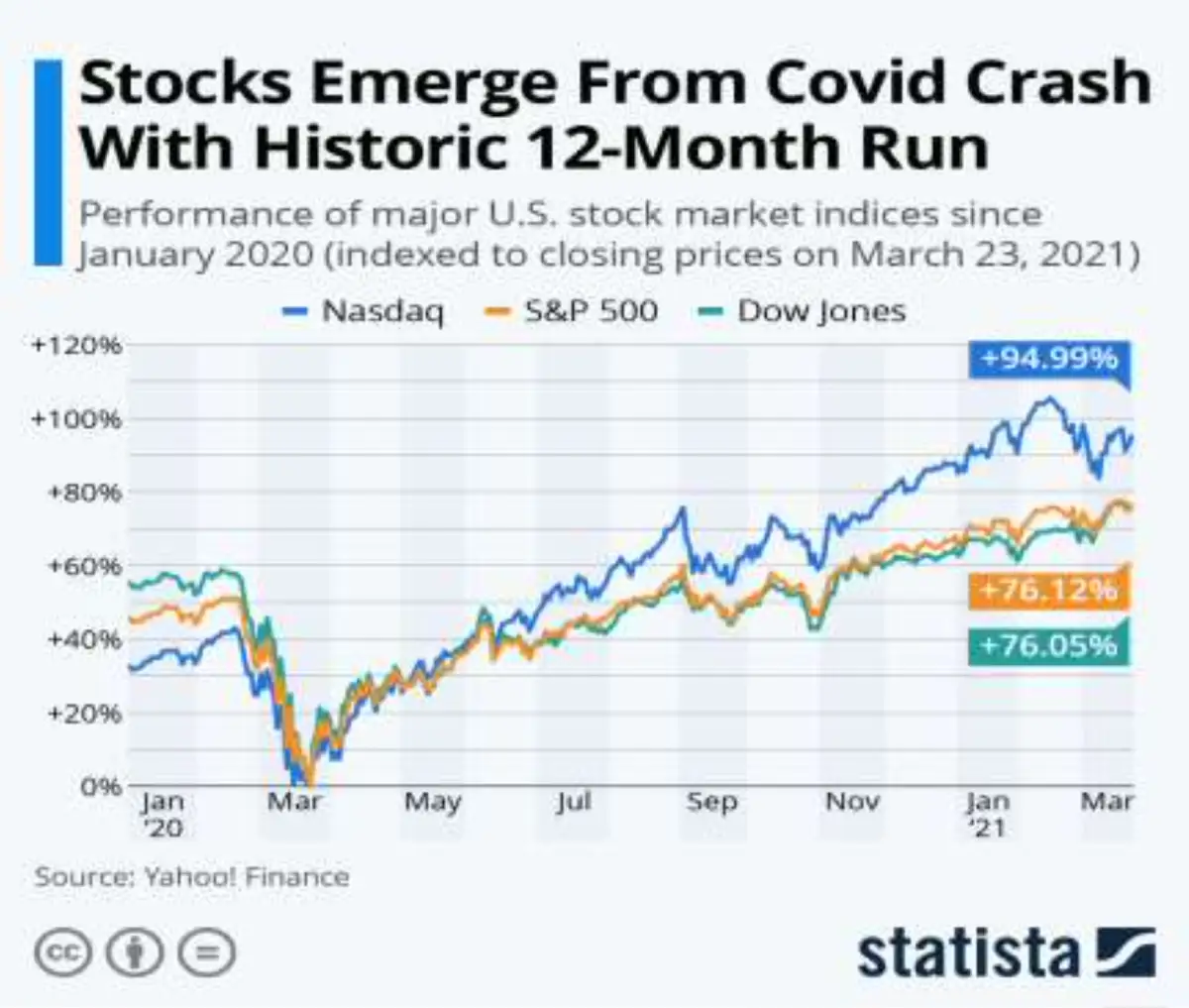

Naturally, my first investments were stocks in which I had a close personal interest so that I would be eager to follow them. I was investing in quality stocks while the S&P 500 rose 29%. I met with Brian so that I could diversify my account into sectors beyond my personal interests. This was in late 2019 while I was still riding a high of being up in the market. I thought I had already figured everything out less than a year into investing. What I wasn’t expecting was that 7,000 miles away, a new virus would begin to spread. I was a senior in high school and could not believe my high school career would end on a random Tuesday due to COVID-19. I went through the summer and watched my investments plummet. There was a supply chain nightmare, people weren’t going out and supporting businesses, and everyone was terrified of investing into a market when there was no end to the pandemic in sight.

In the grand scheme of things, this was a small blip in the history of our markets. For example, in the 2007-2008 financial crisis, the market didn’t start to recover for 18 months. In 2008, there was a -36.55% decline in S&P 500 stocks (the worst return since 1931). In 2009, however, the S&P 500 surged 23.45%.

In July 2022, the S&P was down 15.98% YTD. I started my internship this summer in a historically volatile market. Inflation was out of control, interest rates were on the rise, and many of the stocks that were doing well the previous year declined. What is an investor to do?

One fundamental strategy I learned over my internship is the importance for investors to have an adequate cash reserve. A strong cash reserve can give investors peace of mind, even when the market is down. Investors still have the cushion of saved cash that can be used while allowing their investments to recover. Or even better, buy into the weak market with cash reserves to take advantage of quality investment being on sale.

When I came in for my first meeting with Brian, he showed me a stack of newspapers on his table – some of you may have seen these. Each one was from a different point in history where the stock market was down. The papers were filled with intimidating articles. Despite the media proclaiming there was going to be another Great Depression, it never happened.

One of the main things I have learned this summer is that the market is unpredictable. Experts on Fox, CNN, CNBC, etc. are constantly trying to predict the market, which I know is what they’re paid to do, but is impossible. In an article by CNBC, Jordan Jackson, global market strategist at J.P. Morgan says, “You tend to see down days being followed by very, very strong days…Those strong days

are really, really important in terms of weathering the volatile storm.” I was also taught the importance of receiving income on my investments. Collecting dividends and covered call premium are powerful tools for weathering a temperamental market and the income allows me to accumulate more shares in my investments.

Keeping the Faith

A very used and cliche metaphor in market analysis – a down market can be like a falling knife. There is no benefit in trying to catch the market on its way down. Pulling money out and trying to time the jump back up can make you miss out on the best days. Though it can also allow you to miss the bad days, historically, there is more to gain by leaving money in the market and trusting your plan.

In the same CNBC article Jackson supports the claim of keeping your money in the market, “Staying the course has also proven a more profitable strategy during the pandemic. Take an investor with $100,000 who sold when the market was down 18% as the onset of Covid-19 began to shock the markets. If they got back in six months later, they would have just broken even as of last week, according to Jackson. But if they had stayed the course, they would have about $125,000 today.” That is a 20% difference in staying and trusting the market to recover versus trying to time the market and catching the falling knife.

Nevertheless, despite the historically poor first half of 2022, the history of the market leads this young investor to believe it will come back and then some. Even as a young man, I have learned some things remain true: the Braves will always disappoint in the first half of the season, the Georgia Bulldogs will be better than Florida, and the market has always come back.

Go Dawgs!!!

Jeff Tiller

University of Georgia c/o 2024

References

CNBC Article https://www.cnbc.com/2022/05/17/better-market-days-are-coming-its-just-a-question-of-when.html

Average S&P Return

https://www.investopedia.com/ask/answers/042415/what-average-annual-return-sp-500.asp

Jeff Tiller is a Junior at the University of Georgia focusing on studies in Economics and Finance. Jeff is a graduate of Star’s Mill High School here in Peachtree City, GA where he was an All-District Center for his State Playoff football team.