With a good perspective on history, we can have a better understanding of the

past and present, and thus a clear vision of the future.

-Carlos Slim Helú

As I ponder the current market environment and my children, I recognize they’ll be studying this time period in a future economics course. They’ll read about our nation’s response to a once-in-a-century global pandemic, and the economic aftershock. The trillions in stimulus spending, global lockdowns, supply chain upheavals, and war – all contributing to inflationary and market conditions not seen in over four decades. My young children will have plenty to study one day. For now, it’s time for us to dust off our old textbooks.

Carter-era inflation of the late 70’s and early 80’s immediately comes to mind. The United States was recovering from an oil embargo crisis in ‘73, and with little time to catch its breath, was dealt another energy crisis blow in ‘79 spurred by the Iranian Revolution. As inflation soared, Federal Reserve Chairman Paul Volker aggressively raised the federal funds rate above 20%. As a result, average 30-year fixed mortgages reached a high of 18.45% in 1981,1 unemployment reached nearly 11%,2 and our economy was sent into a painful recession.

Fast forward to present day and our economic backdrop is much less dire than it was forty years ago. Stubbornly, the price of oil remains elevated, and the trend may continue.3 Unemployment remains low, hovering below 4%, while the demand for labor continues to exceed supply. Household balance sheets remain very strong. Household assets to disposable income notched the second highest reading since 1952 during Q1 of this year.4 This figure is likely to fall during the current quarter due to the market contraction, but it speaks to consumers’ saving habits since the beginning of the pandemic. On the liabilities side of the balance sheet, consumer debt as a ratio to disposable income is 11% below its 20-year average.4

Federal Reserve Chairman Jerome Powell is working hard these days. He’s been tasked with combating decades high inflation while attempting to avoid “driving the economy off a cliff.” Recently, the Federal Reserve raised the federal funds rate by .75%, the largest rate increase since the early 90’s. Chairman Powell has hinted at similar rate hikes in the coming months, if the data supports the need. Many investment banks, through their research and surveys, have increased the odds of a recession from almost zero, to that of a coin flip over the next 6-24 months.

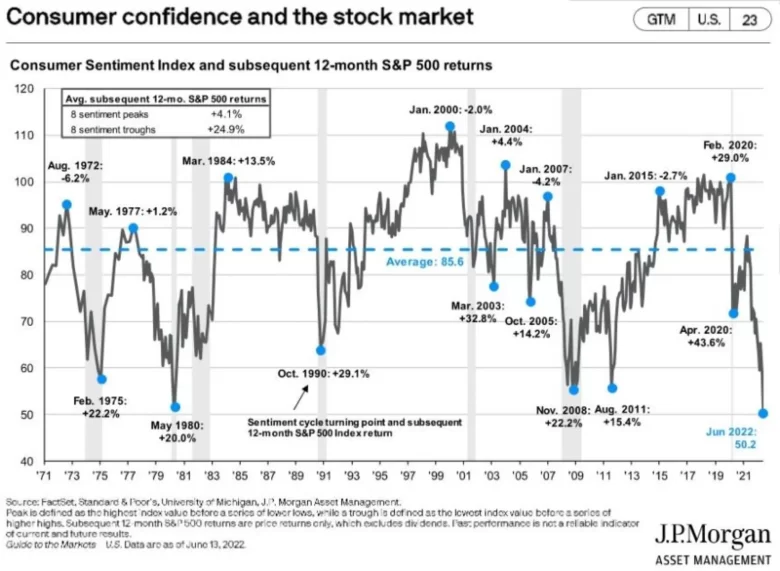

The Index of Consumer Sentiment, compiled by the University of Michigan, seeks to predict the direction of the economy through a monthly survey of consumers. This index is widely followed as a barometer for the consumer psyche and is used to predict their spending behaviors. The preliminary readings for this month’s consumer sentiment fell to their lowest levels since the inception of the survey in the 1940s.5 While the current economic conditions are hardly grim enough to suggest the consumer is in the worst economic environment since the 1940s, this reading is one to note. The consumer is worried about inflation, particularly at the fuel pump and grocery store. Personally, being a consumer of those items, I can empathize.

Recessions happen. Periods of contraction are a normal part of the economic cycle – even if the reminder is irritating. Let’s note this story hasn’t yet played out. There are several indicators, such as a booming services sector and low unemployment, to suggest we may not dip into a recession. Low consumer sentiment combined with fears of a recession do not automatically equate to negative market returns going forward. Let’s take a look at a chart compiled by J.P. Morgan. Their research shows that following the last 8 consumer sentiment troughs, the S&P 500 has returned an average of 24.9% in the subsequent 12 months. These sentiment troughs include the soaring Carter-era inflation of 1980, the financial crisis of 2008, and the onset of the pandemic in 2020. Wading in the market’s waters and facing a strong current of fear, our attitude remains one of long-term optimism.

Given the market volatility, where do we turn? Where do we hide when nowhere feels safe? Great questions. Earlier this year in a previous note we shared our thoughts on shifting away from fixed income. Bonds presented equity-like risk while, in some cases, yielding less than 2%. Defensive equities became the focus – profitable, dividend paying, inflation contending companies. Our research has shown, from 1976 – 1981, by and large, defensive, dividend paying equities, outperformed the broader market. We’ve taken it a couple steps further adding a put hedge to several funds and incorporating covered calls for yield. As of this writing, some of our dividend and covered call strategies are yielding 8-10%, well above the 1.6% yield on the S&P 500. Earning income through dividends and covered calls, as we ride out an undecided market, has been, and will continue to be, imperative.

Eventually, market downturns work to the advantage of prudent investors. During his press conference, moments after the largest federal funds rate increase in decades, Chairman Powell said this, “The American economy is strong and well positioned to handle tighter monetary policy.” We tend to believe him.

Nathan Ellyson, CPA

June 29, 2022

- https://www.freddiemac.com/pmms/pmms30

- https://www.federalreservehistory.org/essays/recession-of-1981-82

- https://tradingeconomics.com/commodity/crude-oil

- https://www.federalreserve.gov/releases/z1/dataviz/z1/balance_sheet/table/

- https://www.marketwatch.com/story/u-s-consumer-sentiment-fell-in-june-to-its-lowest-level-ever-university-of-michigan-271654871099#:~:text=The%20preliminary%20estimate%20of%20the,survey%20in%20the%20late%201940s