Home, don’t it seem so far away

We’re traveling light today

In the eye of the storm

In the eye of the storm

Home, to a new and shiny place

Make our bed, we’ll say our grace

Freedom’s light burning warm

America, Neil Diamond, 1981

The Ma Moment

Jack Be Nimble, Jack be…

October 24, 2020 has officially been dubbed the “Ma Moment” around our offices. It was on that day that the Chinese billionaire, Jack Ma, spoke at The People’s Bank of China Financial Markets Forum. The billionaire was a global star, the Chairman of Alibaba and preparing for the stock offering of Ant Financial, the massive payments platform of his company, Alibaba. Mr. Ma chose the forum to criticize Chinese bank regulators and the Communist Party. This was the Ma Moment. He then disappeared from public view until January 20, 2021 when he reappeared as a more subdued Jack Ma. The Ant Financial initial public offering (IPO) was scuttled by Chinese regulators, and, in our opinion, global events were set in motion and are still being felt. We should explain that in our analysis, America had been seen globally in a somewhat diminished stature, this following the Iraq/Afghanistan expeditions, cast as an aspirational imperial power. Then, seemingly in direct conflict with an imperial power construct, America was portrayed as a fading power, retreating to its domestic borders, abandoning numerous international organizations and treaties. Worse still, accusations were floated questioning American commitment to uphold defense pacts with various regions in the world.

China and Russia were flexing seemingly powerful muscles, both economically and militarily. America had supposedly seen its last days as the sole global superpower. Then the Ma Moment occurred and quietly, multiple Chinese business and technology leaders exited their commercial roles. In 2021, Zhang Yiming, founder of ByteDance (owner of Tik Tok) stepped down. Su Hua, CEO of Kuaishou shed his titles, Colin Huang, founder of Pinduoduo exited his executive roles. This month, Richard Liu has resigned as CEO of JD.com, the e-commerce giant he started. The Ma Moment reverberated throughout China as Chairman Xi made it known there would be no criticism of his Communist Party, nor any undue focus on capitalist ideals and freedom of expression. We do not feel China’s environment foments creativity and entrepreneurial zeal, rather, repression and Maoist dogma.

Tectonic Shifts

But the Ma Moment was also felt elsewhere. In the Kremlin, Vladimir Putin was watching with envy as Mr. Xi brought his country to heel. Putin had quietly exercised a similar throttling of his oligarchs over the years, causing many to scuttle off to London, moving their wealth out of the Kremlin’s immediate grasp. Putin went as far as to prosecute Mikhail Khodorkovsky and imprison him for six years. The Putin message mirrored the Ma Moment. Putin even amplified it with various poisonings of political rivals and other targeted Russians guilty of being unpatriotic. Then came Ukraine. This will prove to be an economic and humanitarian earthquake for the world, but a tsunami of opportunity for American interests. Almost overnight, countries discarded the fading global superpower adage and realized the world had suddenly become uneasily unipolar once again. The only free, thriving, liquid markets existing, of any consequence, were American. Military intervention was welcomed, and NATO, an organization that had supposedly outlived its usefulness, was centerstage. American weapon systems are in- demand. Europeans find themselves awkwardly tethered to Russian energy. Suddenly, American liquid natural gas (LNG) is an alternative for the continent. Germany has initiated construction of LNG terminals to berth our ships carrying this valuable cargo. We would put our money on the American energy complex as it prepares for greater LNG demand. There will be added focus on our own homegrown production, all the while nurturing the renewable energy rush that is well underway.

Xi has continued his battle with COVID and further shuttered China. Factories are closed, streets empty, Chinese vaccines ineffectual. China finds itself a reluctant supporter of Putin’s miscalculation in Ukraine. Each day that passes makes it harder for China to support Russian policy, but it sees Russia as a critical part of its strategy to counter America. Observing the annihilation of armor and battleships by modern weapons deployed by a smaller Ukrainian force cannot help but bring pause to Chinese strategists. Aggressive moves in the South China Sea and over Taiwan will be carefully reassessed.

Incursions into Ukraine instigated a financial war. Quickly, global banks agreed to sanction Russian business and prevented Russian banks from utilizing the SWIFT bank transfer system. Global dollar transfers are near impossible for Russia. Trade was frozen with the West. India, China, and other nations, including some African nations, continue relations, but find the going difficult with ruble denominated contractual trade terms. The ruble has never been a desired currency and now is obviously perilous to transact. The Ma Moment reverberates. North Korea, feeling slighted, has begun launching missiles hither and yon, begging to be acknowledged in the same breath as Putin and Xi. Iran quietly tries to destabilize Iraq with militias and missile strikes, such as the recent March strike on Irbil. Escalating attacks against Israel are also part of the mix. This month, Turkey, a NATO member, decided to stage attacks in northern Iraq to oust Kurdish fighters they have been battling for years. It seems nobody wants left out of the action.

Capitalist Overtones

What we find curious is that all this upheaval is happening at a time when global wealth has never been greater. Since 2000 global wealth held by households, companies, and governments has tripled from $160 trillion to $510 trillion. This has played no small part in the stock market and real estate appreciation from which we have all benefitted. Fed Chairman Bernanke called this phenomenon “a global savings glut”. China and Russia have been direct beneficiaries, as has the United States. Why all the anger? One client astutely pointed out that all this instability, not least politically in our own country, could be marked-up to the surprising difficulties attributed to the transition from an industrial age to an information age: speed of change being the culprit.

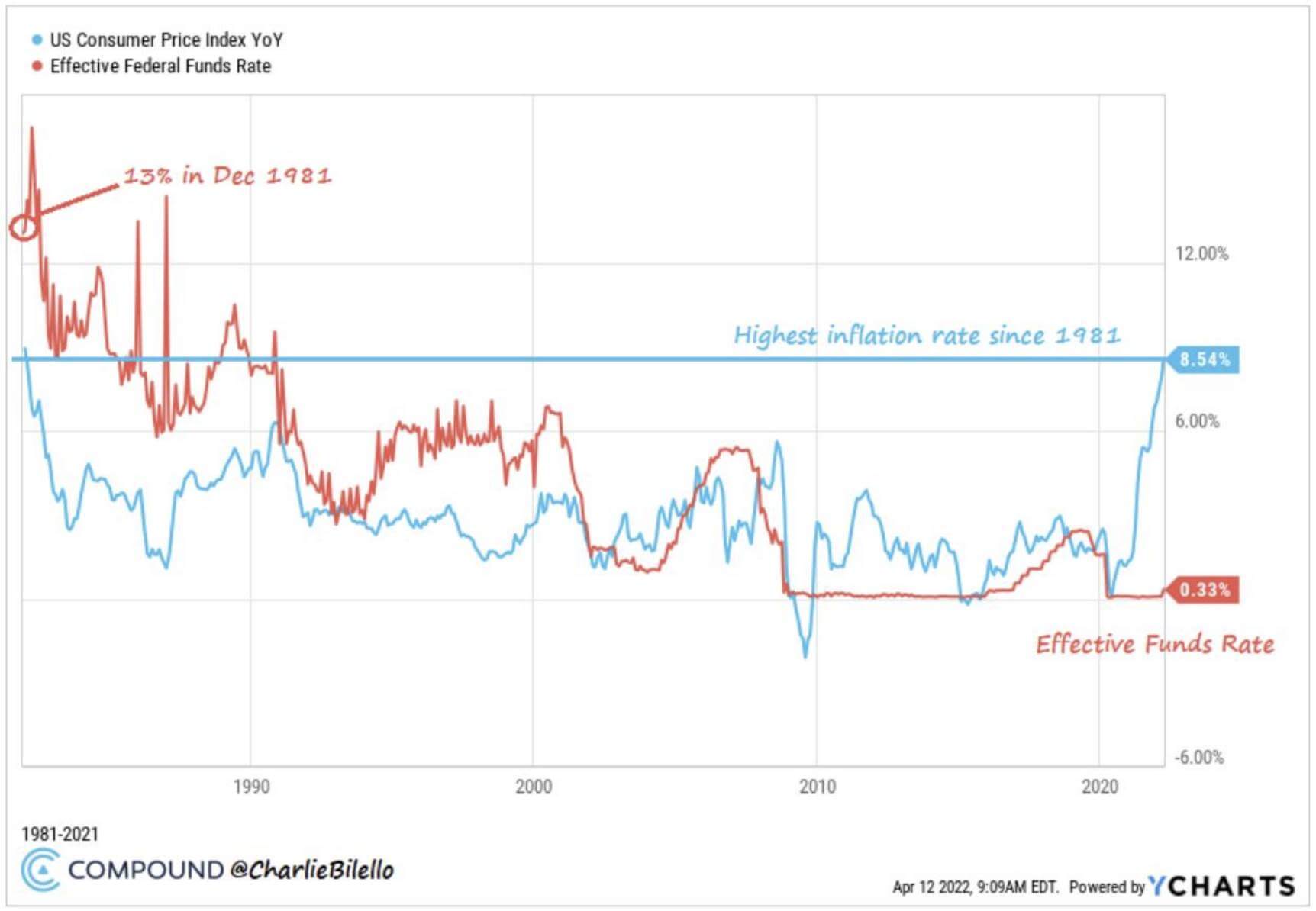

In America, inflation has raised its ugly head. Over a decade of expanding the money supply is coming home to roost. Our friends at Aptus Capital passed along an interesting tidbit from Charlie Bilello of Compound Capital Advisors. The last time inflation was at 8.5% (1981) the Fed Funds rate was at 13%. Presently the Fed Funds rate is at .33%; this is not a replay of Volcker era inflation.

Ukraine stokes this upward price pressure as grain production will fall off dramatically. It is tremendously difficult to seed wheat fields while Russian tanks sit in the tractor’s path. Coming out of COVID has unleashed surprising American consumer demand. Federal Reserve Chairman Powell believed this price pressure was transitory and that inflation would diminish as supply chains stabilized. Then Ukraine thoroughly scrambled Powell’s model. Pundits have made much noise about Powell being late to the game in raising rates to quell inflation. Predictions of dire economic consequences are not hard to find despite the savings glut. What they all miss is the Ma Moment. By thrusting America onto center stage, the world will likely enable a soft landing for the Fed. Thereby allowing Powell to gently raise rates and not tip the country into a deep recession.

Rising rates will lure foreign buyers to US Treasury auctions as we have discussed in previous Updates, possibly putting a cap on how high these bond yields can rise. With the elevated fear factor in global markets, it is difficult to envision problems with funding our deficit. Buyers for our debt will be plentiful. Demand for American goods will remain strong in agriculture, energy, and defense. Russian and Chinese technology workers are searching for a new home: Dubai has already seen an influx of Russian tech talent. America will also benefit from this brain drain.

Thank You, Mr. Ma

We feel it is a mistake to discount America’s financial markets or to expect severe, prolonged downturns. An example of the pull of our money centers is best exemplified by the recent announcement that the pride of German automotive supremacy, Porsche, would go public. We did a double-take when we saw the bankers on the German deal: Goldman Sachs, Bank of America, JPMorgan, and Citi are the selected coordinators of the IPO. For such a prestigious German IPO to skip Deutsche Bank seems unthinkable. The fact remains that the richest, deepest capital markets exist in the United States. This will only become more evident in coming years.

We anticipate a rocky 2022 with surprises coming far too often for our tastes, after all, it is an election year. The Federal Reserve will do everything they can to slow this economy in order to fight inflation. The economy will therefore slow, possibly into a shallow recession, but we see little chance of a debilitating 2008 type scenario. That said, we suggest riding through the tumult and ultimately enjoying the fruits of an economy that will remain powerful, robust, and free. Neil Diamond’s “America” seemed to hit the proper note for us. The refugees fleeing the oppression of war and dictatorships will find a home, many will land here where they will find “freedom’s light burning warm.” Our portfolios will benefit. Thank you, Mr. Ma.

E.B. “Chip” Beard

April 21, 2022