Farming looks mighty easy when your plow is a pencil,

and you’re a thousand miles from the corn field.

-Dwight D. Eisenhower

My father grew up on a large dairy farm in Ohio. The farm is still owned and managed by my northern relatives. Their cattle produce milk, morning and evening, rain or shine, every day of every season. If only everything was so constant and predictable! Their crops are different. Sunlight, water, fertile soil, and healthy seeds are the key components of a plentiful crop. Each component is crucial and often relies on specific measurements, precise timing, and care. Surely if water – the source of life – is reduced, the crop yield will suffer, or worse, fail. What a challenge during a dry season.

Like crops, an investment portfolio has several components that often require measurement, timing, and care. Depending on your age, risk tolerance, needs, and financial goals, a measured allocation of equities and bonds has long sufficed – even thrived! Like water, sunlight, and soil – interest, dividends, and market appreciation all play a role in the health and growth of a portfolio. But what happens when we look up in the sky and see few rain clouds?

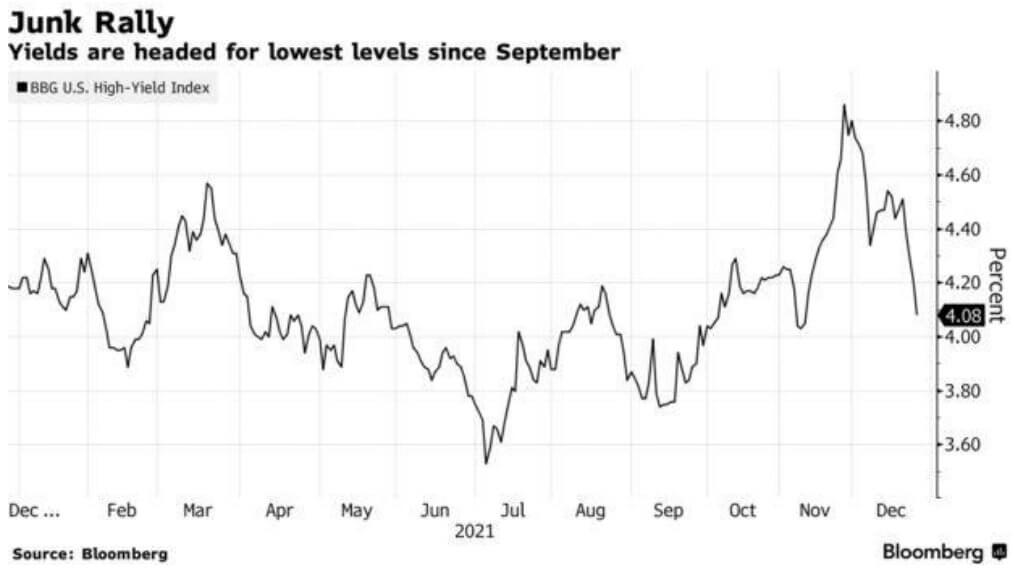

Bonds have enjoyed a multi-decade bull market as interest rates have spiraled downward to just off the historic lows of 2020.Investors looking for safety and the budget support of fixed income payments have been challenged. The 10-year treasury yield (as shown) has only seen a few brief moments above 3% in the last decade and has spent most of that time hovering around or below 2%.1 Bond market expectations remain mixed even as Federal Reserve Chairman Jerome Powell indicates multiple rate hikes over the next couple years.

We own and appreciate equities for many reasons: future cashflows, dividends, growth, and the excitement of participating in future innovation. But that’s not all. There is a substantial derivatives market tied to equities known as options. Options derive their value from their underlying security. Options can be bought, sold, and used in a multitude of strategies to mitigate risk and produce income. One of the most basic strategies is selling a covered call. Selling a covered call allows the shareholder to collect additional income on their equity position by selling the right to relinquish their shares for a specific price expiring by future date. This specific price, known as the strike price, is often much higher than the current market value, leaving room for price appreciation.

Depending on the strategy, covered calls can be sold repeatedly – week to week, month to month – producing income for the shareholder through collecting the option’s premium, in addition to the share’s scheduled dividends. Options are complex. The risk of selling a covered call is the share price appreciating very quickly and reaching or surpassing the call option’s strike price before the expiration date, leaving the shareholder obligated to relinquish their shares or to repurchase or roll the option contract to a future date. Like many market decisions, risk can be reduced through prudent strategy and statistical analysis.

Let’s review an example. 100 shares of XYZ stock are purchased for $100/share. The $120 covered call expiring in one month is then sold for $1 – which equates to $100 in premium received by the shareholder ($1 x 100 shares). The covered call premium is the shareholder’s to keep, regardless of where XYZ trades during the month. Putting the risk into perspective, if XYZ appreciates above the $120 strike price, the shareholder would be obligated to sell their shares at $120 or 20% above their original purchase price. We’re able to limit risk, and target maximum returns, by selling covered calls with favorable upside potential.

When tasked with yielding crops in the desert, we believe supplementing using option premium, and leaning less on stressed bond yield, will help smooth the volatility in fixed income as the Fed implements their first rate hikes since 2018. We’ve striven to be prudent in our implementation of funds and select strategies. This year is already gearing up to be exciting. We’re here to help with your questions and offer further insight.

Nathan Ellyson, CPA

February 17, 2022