By: Jon-Luke Hawk

Senior, Hillsdale College

Derbend Asset Management 2021 Intern

College is full of distractions. Social media and friends are among the most popular, but I would like to add angry tenants to the list. I want to tell a short story about a rental house I manage while earning my undergraduate degree at the nearby college. The house is a single story, three-bedroom, one bath in a college town located in southern Michigan. I chose this story because, in my opinion, it gives an engaging snapshot of the day-to-day reality of real estate ownership, in contrast to securities real estate investment. My tenants at that time were two upperclassman college students to whom I rented the house after my purchase earlier that summer. One day, while I was busily working on mountains of homework in the library, I received a call. The annoyed voice on the other end of the line informed me that the hot water was out. I spent the next three days scrambling to resolve the problem, all while the tenants became more and more aggravated due to their un-showered state! It ended up, however, being the tenants own fault! It turns out the city does not take kindly to tardy payment of the gas bill.

I tell this story to illustrate a point: Physical rental properties can help diversify a portfolio and provide income, but can be a large amount of work, risk, and perpetual problem solving. Rental property is a viable financial option for those of us who can devote the time and money to it, but for the savvy investor, there is another, more convenient option – a Real Estate Investment Trust (REIT).

What is a REIT?

“A real estate investment trust (“REIT”) is a company that owns, operates, or finances income-generating real estate. Modeled after mutual funds, REITs pool the capital of numerous investors. This makes it possible for individual investors to earn dividends from real estate investments—without having to buy, manage, or finance any properties themselves.”1

REITs intrigued me when I was first introduced to them. Here was an asset class that merged attractive attributes of stocks with the benefits of traditional real estate investment. REITs seemed to combine the best of two worlds, finding a niche where an investor can get the risk adjusted benefits from physical real estate along with the characteristics of security and liquidity from stocks.

To further explore this opportunity, this article will showcase three other reasons why REITs may be a good addition to portfolios: 1) REITs traditionally have lower risk than actual real estate investments, 2) the dividend benefits they have as a result of their structure add further value, and 3) their inherent inflation protection can all work together to significantly strengthen a portfolio.

Not all REITs, however, are created equal. It is easy to imagine in a post-Covid, work-from-home world that traditional office real estate will fare challenges. The same could be said for brick-and-mortar retail portfolios. Nevertheless, there are some areas that seem to be poised for success given the current trends in the economy. Some examples are Data Center REITs and Healthcare focused REITs. There will be some more explanation later, but, as an introduction, the emergence of 5G technology could be a profitable option for investors.

Lower Risk

“REITs are safer because they’re well diversified, professionally managed, liquid, and have better access to capital.”2 REITs maintain the flexibility of stocks, while keeping the benefits of real estate, such as its lower risk attributes.

REITs physically hold real estate properties, so they are less prone to drastic volatility in equity markets compared to common stocks. This allows for a more stable investment experience and more of an opportunity for dividends.

REITs have also outperformed a baseline of U.S. Stocks, as shown in this graph from Nareit3

Exceptional Dividends

Dividends are great for long term investors in need of income producing assets. An investor could use this money to pay living expenses in retirement or reinvest dividends to compound total return. Part of the reason REITs can pay higher dividends than normal stocks is because of their regulatory structure.

“REIT’s dividends are substantial because they are required to distribute at least 90 percent of their taxable income to their shareholders annually. Their dividends are fueled by the stable stream of contractual rents paid by the tenants of their properties.”4

This is great news for the investor. Those steady income streams mimic the physical real estate market, with relatively secure future income.

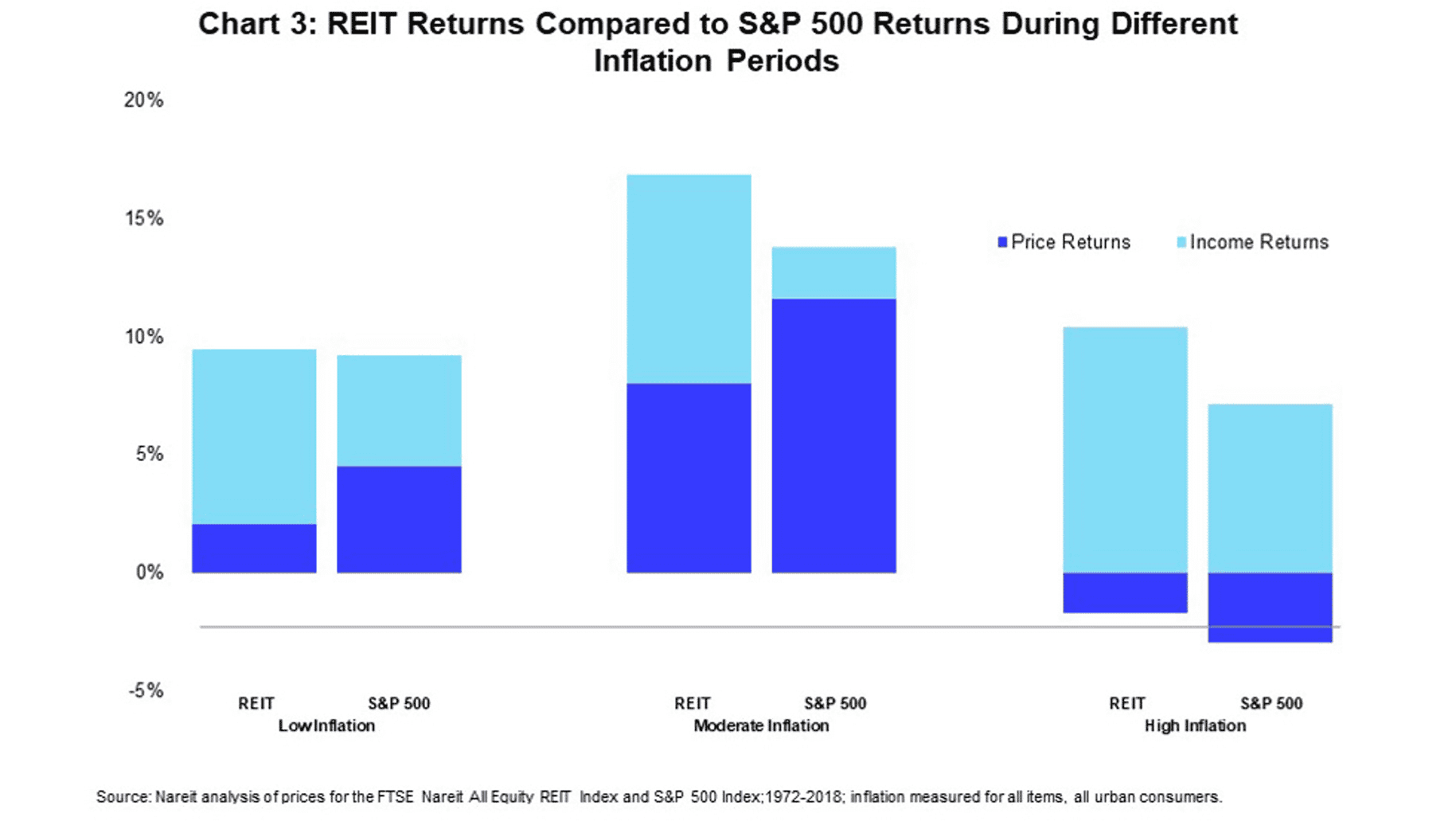

Inflation Protection

The question of inflation has been on the minds of investors lately, especially for retired investors living off their portfolio. Will we see a sharp rise in the coming months or years? Or will it stay at the current growth rate? Whatever the future may hold, REITs give a good option for inflation protection again due to their inherent attributes and structure of the leases they use. NAREIT again sums the principle up nicely:

“REITs provide natural protection against inflation. Real estate rents and values tend to increase when prices do, due in part to the fact that many leases are tied to inflation. This supports REIT dividend growth and provides a reliable stream of income even during inflationary periods.”5

The Interesting World of Data Center REITs

A data center is a large, box building that houses servers and other data storage tools for companies. They are also outfitted with special features that improve performance for those servers, such as cooling technology and backup generators. What makes this an interesting investment opportunity is that these buildings are leased by the companies using them. A REIT focused on this sector, such as Iron Mountain or Digital Reality Trust, would build or buy these buildings to suite and then lease them to data companies. Talk about exceptional tenants! The servers are not going to cause property damage, complain about neighbors, or forget their gas bill, which makes them a reasonably stable form of income.

Numerous factors point to the economy progressively moving towards the need for more of these centers. 5G is one of the most important of these advancements in need of data centers. 5G is a step up from the services our phones currently have, with faster speeds, better coverage, and increased connection between devices. With this advancement set to reach most of the country, many companies will most likely need the infrastructure to make it work. A part of this new need will be the data centers in which REIT’s are investing – which makes them all the more attractive to investors.

Conclusion

I hope you have found this brief discussion of REITs interesting. For the investor who is looking for the security and stability of real estate with characteristics of the ease of stocks, in addition to exceptional dividends, then REITs could be a wise addition to a portfolio.

1 Source: Real Estate Investment Trust (REIT) Definition (investopedia.com)

2 Source: https://seekingalpha.com/article/4437280-why-warren-buffett-buys-reits-instead-of-rental-properties?lift_email_rec=false&mail_subject=why-warren-buffett-buys-reits-instead-of-rental-properties&utm_campaign=nl-morning-briefing&utm_content=link-0&utm_medium=email&utm_source=seeking_alpha

3 Source: https://www.reit.com/news/blog/market-commentary/reit-average–historical-returns-vs-us-stocks

4 Source: https://www.reit.com/investing/why-invest-reits

5 Source: REITs and Inflation Protection | Nareit