There’s a starman waiting in the sky

He’d like to come and meet us

But he thinks he’d blow our minds

There’s a starman waiting in the sky

He’s told us not to blow it

Cause he knows it’s all worthwhile.

– David Bowie, 1972

Meanwhile back on earth, with global economies staggering under Covid-related issues, earthly leaders have taken to lashing out. This makes some sense as they try to distract the commoners from the misery surrounding them. Mr. Putin has once again taken to poisoning his opponents, this time striking opposition leader Alexei Navalny. President Xi has purged disloyal Party officials in an anti-corruption campaign (always convenient for implementing ideological purity) which seems to be securing his continued rule well into the future. He is reportedly considering re-instituting the title “Party Chairman”, last used in 1982, and effective for Chairman Mao in having no set term limit.

The economic basket case known as Belarus, a former Soviet republic, has its leader, Alexander Lukashenko, a twenty-six year rule under his belt, detaining opposition leaders and having daily rioting in the streets as he clings to his post. Deputy Crown Prince of Saudi Arabia, Muhammad bin Nayef was arrested for treason in an apparent consolidation of power in the Kingdom, and Hong Kong police have arrested pro-democracy lawmakers to quiet the pesky legislators.

Never one to be a shrinking violet (like his currency, the Lira), President Recep Erdogan of Turkey has shunned most western advice and used Turkish naval vessels to escort gas exploration ships into disputed Cypriot waters to claim recent gas discoveries offshore. Of course, Turkey’s invasion of Northern Cyprus decades ago still rings painfully with Cypriots as UN Peacekeepers continue to keep the factions apart on the island. Not enough for a man of such stature, Erdogan has begun supporting Azerbaijan in the flourishing war with Armenia in disputed Nagorno Karabakh. Western leaders have pleaded with Turkey to end their support for the slaughter, but to no avail. Sprinkle in Brexit and Indo-Chinese hostilities on their common border, and we think investment in Emerging Markets is a bridge too far. Considering all this destructive global activity, U.S. election antics seem to have a junior varsity feel to them.

Our watchful eye this quarter falls on certain real estate securities which could sustain sizeable declines from Covid-related activity. Condominium units from Miami to New York would be high on our list. This segment of the market has vulture investors circling and will see continued weakness in our opinion. Along those same lines we are closely watching Commercial Mortgage Backed Securities (CMBS). This class of security grew out of the Savings & Loan (S&L) crisis in the 1980s when hundreds upon hundreds of S&L institutions disappeared and developers needed financing. CMBS work by having banks originate loans and then sell the loan to a trust. This trust employs a master servicer to collect the bond payments for the trust. Three main master servicers are Wells Fargo, KeyBank, and Midland Loan Services. If a payment fails to materialize the servicer forwards their own money to the trust, limited to the value of the property. This arrangement earns Wall Street a triple-A rating. When the 2008 financial meltdown occurred, many of these trusts failed when delinquencies, especially in residential mortgage bonds, skyrocketed. Since 2008, underwriting has improved, but Covid fiercely struck commercial real estate. The Federal Reserve’s buying of triple-A rated securities has stabilized the CMBS market since its March declines; nevertheless, the fate of commercial buildings hangs on the manner in which business returns to offices and business travelers return to hotels. Companies have raised more debt this year than ever before. Going into September, U.S. corporate bond sales came in around $1.9 trillion. Stay tuned.

Another point of interest is the surge in Chinese capital markets. Long a backwater of finance, China has surged as they shake-off Covid and return to work. ANT Financial, the payment arm of e-commerce giant AliBaba, is expected to list publicly on the Hong Kong and Shanghai exchanges, with an expected valuation north of $250 billion. Then, in October, China had its first offer of Chinese bonds (denominated in Dollars) to US markets. The $6 billion offering was enthusiastically met by investors, widening China’s financial footprint in the U.S. In related news the Port of Los Angeles reported record imports in September, many from China. The Chinese machine is

continuing to hum. Watch Chinese stocks such as Alibaba, NIO, and Baidu for opportunities to diversify portfolios.

Domestically we see developments in the corporate sector as generally positive. Obviously, hotels, airlines and cruise lines continue to smart from virus shutdowns but other sectors are benefitting.

The much-publicized technology rally is one area thriving, but many corporations have engaged in what could be termed opportunistic layoffs, using the virus as an excuse to thin the ranks. With this dynamic in 2020, it is possible that earnings in 2021 will be strong on the back of leaner work force numbers, less business travel, and greater utilization of technology. Many of the stocks in the Standard & Poor 500 that have not participated in the 2020 recovery rally could see attractive Price/Earnings multiples (PE ratios) coupled with hefty dividend payments. Convertible bonds and some defined option strategies might offer rational methods to enhance yield. We will utilize such strategies on a case-by-case basis.

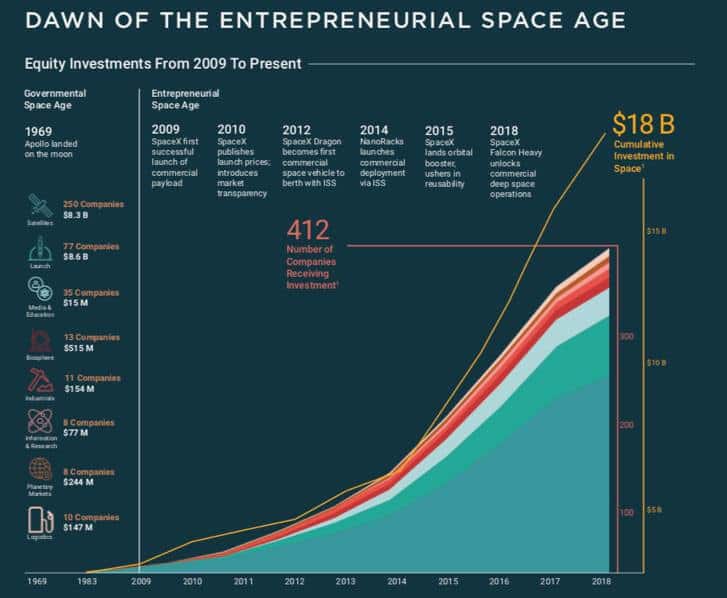

The entire space sector has come alive as well. Elon Musk’s SpaceX has been in the news often, using its fleet of rockets to boost satellites into orbit, service the space station and perform functions for the Department of Defense. The Pentagon has awarded SpaceX $1.1 billion in contracts since 2002 and the Air Force just awarded a launch services contract worth considerably more than that total. SpaceX has plans for global broadband services originating from space. They have placed 600 of their StarLink system satellites with plans for 12,000 birds in their total coverage. This network also interests the Pentagon. The military is looking for an array of satellites large enough to sustain attack.

SpaceX just might have an answer as it provides remote regions of Earth with broadband services.

Aerojet Rocketdyne (Symbol AJRD), Jeff Bezos’ Blue Origin and Richard Branson’s Virgin Galactic are all companies in the commercial space race. Branson has recently taken Virgin Galactic public (Symbol SPCE) and completed a Space Port in New Mexico for space tourism. The commercial appeal in space is getting notice. The Japanese Hayabusa-2 spacecraft is currently rocketing home with a payload of sub-surface materials from an asteroid 180 million miles from Earth. The vehicle fired a bullet at the asteroid surface and collected resulting fragments. The hope is that asteroids will be rich in valuable minerals needed in a variety of commercial activities, and the Hayabusa platform could enable such asteroid mining.

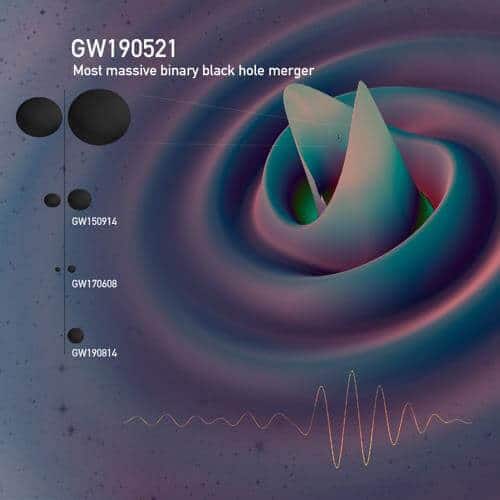

There are a multitude of reasons to be excited about corporate developments in 2021. We look forward to moving beyond the election noise and into a new year. We know the starmen are watching to see if any of our extraterrestrial efforts, or bond holdings, stray off course and end up sucked into GW190521; after all, they told us not to blow it cause they know it’s all worthwhile.

E.B. “Chip” Beard

October 20, 2020