By: Brandon Ben-Hanania

Senior, University of Wisconsin – Madison

Derbend Asset Management 2020 Summer Intern

You don’t dare check your watch. After the fourth dealer change, you know it’s time to leave. But that smoky wood scent so distinct you can almost taste it on your tongue, the endless, carnival-like sound of slot machines, the unlimited flow of complimentary vodka tonics and martinis, and that ace the dealer just flipped over in front of you makes it feel as though you’re in one of those dreams where you can’t move, no matter how hard you try.

You watch with maddening anticipation as the dealer makes his rounds around the table, deftly distributing cards to each player, some stone-faced table veterans down a couple thousand, others wide-eyed, hopeful newcomers who will gradually morph into one of these veterans over the course of a few hours. At last, the dealer flips over his own card.

It’s an ace. You reach for your vodka tonic.

Like the insurance the Las Vegas dealer offers when he turns over his ace in a game of Blackjack, bonds can provide similar risk insurance. Or at least they used to.

In Blackjack, players buy insurance to hedge against the risk of the dealer having blackjack which will cause them to take an immediate loss. When the cards have been dealt, there is one card face-up and one card face-down. If the dealer shows an ace face-up, he will ask all the players at the table if they would like to purchase insurance. This is because it is more likely the dealer has blackjack than any other unique hand since there are 16 cards with the value of 10 (10, jack, queen, and king) that could be the dealer’s face-down card. Insurance will pay out the buyer if the dealer has blackjack, while all other players who did not purchase insurance will take a loss.

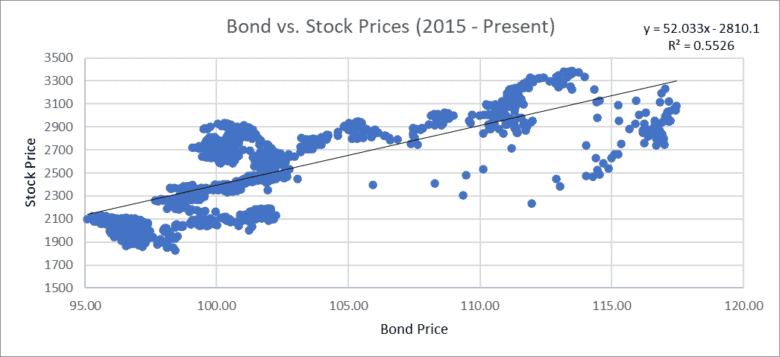

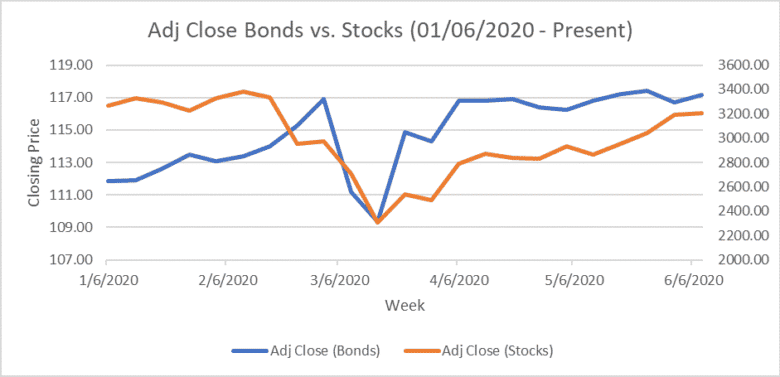

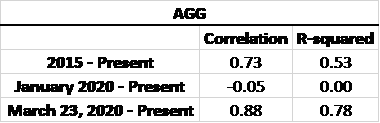

One reason investors purchase bonds is to hedge against the risk that the stock market will contract. Those who purchased bonds should – in theory – benefit since theoretically, bonds gain in value when stocks decline.

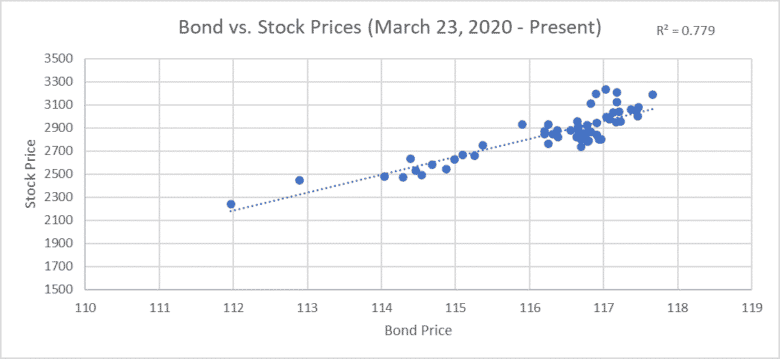

This shift, however, seems counterintuitive. Many would believe that the lockstep movements of stocks and bonds should decrease after this large crash given investors flight to safety to the bond market as the stock market becomes more volatile. Historically, investors seek safe-haven by investing and hedging against risk in the stock market by investing in bonds.

Furthermore, the reduced value of bonds as a hedging tool may lead to shifts in portfolio construction. Instead of 50/50 or 60/40 equity to fixed income splits, investors may now prefer 70/30 or 80/20 portfolio splits. If the fixed income portion is not as effective in reducing portfolio risk, why would investors sacrifice the higher potential returns from equities for lower returns from bonds? It is true that bonds will still offer investors reduced risk from the guaranteed coupon payments, plus principal repayment – provided the company does not default. In contrast, stocks enable investors to earn returns from increases in share price. However, bonds are not as effective at reducing risk as they would be with less similar-direction price movement with stocks because the gains in bond prices will not offset the losses in stock prices by as much. Therefore, in the short- and medium-term future, markets may see an overall rise in value of equities as demand for them rises and an overall decrease in value of bonds.

Finally, this trend may cause overall bond yields to increase until the positive correlation between bonds and stocks decreases in order to account for the less effective risk hedging. If equities increase in demand and bonds decrease in demand, bond yields may rise in attempts to entice investors to invest more in bonds. However, since investors can receive more value in equities than bonds, they will not flock back to bonds so quickly, creating rising bond yields. It’s equivalent to the players at the Blackjack table receiving a higher payout for the same cost if their insurance pays off, that is, if the dealer has blackjack.

The most probable reason for this heightened direct relationship after the market low in March involves investors purchasing bonds in anticipation of future economic uncertainty.

Another particular area of interest is foreign investment: In March and April 2020, data has shown a large number of U.S. Treasuries owned by foreigners were sold back to Americans1, which may have caused the initial decline in the bond market instead of a surge as would be expected. Further, foreigners bought $6.81 billion of U.S. stocks in March compared with purchases of $11.52 billion in February. Foreigners bought $3.18 billion in U.S. corporate bonds in March compared with sales of $20.52 billion of these assets in February. This simultaneous purchase of U .S.1 stocks and corporate bonds in the month of March, compared to a purchase of stocks and a sale of corporate bonds by foreigners in February, may have contributed to stocks’ and bonds’ lockstep price moves.

It turns out that Europeans like Blackjack insurance as well. A new type of European bond, dubbed “Corona Bonds,” have entered the financial sphere2. This type of bond is unique in that it would be backed by the entire European Union, , consisting of 27 countries, making it a much safer investment than a bond backed by any one country alone. Consequently, this bond issue may decrease demand for U.S. Treasuries since a debt instrument backed by the entire EU may be safer than a debt instrument backed by the United States alone. Because of this, the U.S. may have a tougher time financing the deficit due to decreased sales of U.S. Treasuries, creating higher concerns of long-term solvency issues, and a greater strain on the U.S. economy. This decreased demand in U.S. Treasuries may force the U.S. government to raise yields on these bonds to incentivize more investors to purchase them.

So, the next time you’re playing Blackjack in Vegas and you see an ace appear in front of the dealer and he asks you that inevitable insurance question, you will be thinking about bonds. I hope I didn’t ruin the game for you. But if I did, have another vodka tonic on me. Or, rather, the casino.

1 Source: U.S. Federal Reserve (www.federalreserve.gov)

2 Source: Euronews (https://www.euronews.com)