“The dollar is our currency, but your problem” – John Connally, Secretary of the Treasury, 1971

Merriam-Webster defines bludgeon as 1. A short stick that usually has one thick or loaded end and is used as a weapon 2. Something used to attack or bully.

It occurs to us that the US Dollar is rapidly meeting both definitions at least according to the good dictionary. We view as unfortunate the slow evolution from the global Reserve Currency of choice to its new role as a bludgeon weapon. It would serve everyone to pause and reflect on what brought the US Dollar to global dominance and Reserve Currency status and the impact of the greenback’s werewolf-like morphing from friend to fiend for many of our international partners.

A History of Dollar Supremacy

Following WWII, the United States enjoyed vast commercial benefits versus the rest of the world: at times half of global GDP came from the US. The Dollar was held by Central Banks the world over (and still is today) to settle trade finance deals, to enable international funds transfers, and to allow for the settlement of most commodity purchases.

The Dollar’s status as the world’s Reserve Currency has been a massive benefit to the United States. Not only has it has made trade easier and cheaper, as most transactions involve our currency, it has allowed the consistent devaluation of the US Dollar since we abandoned the gold standard in 1971 and allowed the Dollar’s value to float versus other currencies.

One result of devaluation has been ever-increasing sales of Treasury bills and bonds. The US has financed massive deficits from our depreciated currency which other Central Banks must hold while the Treasury continues to sell government paper to fund ever widening deficits, whether they result from entitlement spending or tax cut financing.

Having our monetary cake and eating it too is an enviable position every other nation in the world would enjoy having, but we seem to take it for granted. Only the Euro has any immediate and real possibility of being a solid Reserve Currency globally, but its future has been problematic with ongoing European Union economic and political disunity.

For nearly 50-years, we have become accustomed to the world’s need for greenbacks. Recently, however, the United States has found a new and useful way to utilize our Reserve Currency; as a bludgeon.

In your FATCA!

The weaponization of the Dollar as policy began in 2010 when President Obama signed the Foreign Account Tax Compliance Act (FATCA) into law. This interesting legislation, intended to catch tax dodgers, ordered foreign financial institutions to report to the Internal Revenue Service any US citizen associated with any foreign account. Naturally, foreign banks were not too keen with the idea of reporting anything about their clients to a foreign government and quickly pushed back.

In response, the US Treasury Department quickly pulled out the bludgeon and informed foreign banks harboring independent ideas of being unaccountable to foreign governments that they would either comply or lose access to US Dollars. No foreign bank can operate without access to the world’s Reserve Currency so the bludgeon landed its blow and financial institutions around the world snapped into compliance. Many simply closed the accounts held by US citizens which came as a rude surprise to the many businessmen and women toiling abroad.

FATCA created ill will around the world, but the greenback’s dominance was unchallenged. Government paper representing a safe haven in tumultuous times continued to fly off the shelf and US deficits soared as attractive terms fueled government largesse.

Once the FATCA-bludgeon, and the threat of lost access to the Greenback, proved successful the strategy begged repeating. Iran seemed a good candidate for just such a beating. When the Obama Administration, along with the other permanent members of the United Nations Security Council plus Germany, eased sanctions on Iran in 2016 as part of the Iranian nuclear deal framework, global businesses began plans for potential dealings in Persia.

The new deals were ready for signing until it became apparent that the Treasury Department would not condone US Dollar transactions with Iran. Transactions then became much more difficult to structure. Even the pallets of cash included in the Iran nuclear deal and sent to Iran from the United States were denominated in Euros, Swiss francs and other currencies to avoid Treasury’s ban on US Dollar transactions with the Mullahs.

The bludgeon was effective and it slowed developing commercial relations with the Islamic Republic of Iran. Business owners, both abroad and in the US, lamented lost opportunities. But the technique was once again proving effective and the Dollar’s use as a weapon grew to become unlike anything utilized by the US Military.

New Uses for the Bludgeon

A new Administration is in office and is all too eager to utilize the bludgeon. But this time the targets are not tax-cheaters or members of the “Axis of Evil”, they are hapless nations eager to launch dealings with countries deemed national security threats to the US or violators of sanctions imposed by our government. National security issues now take the form of steel and automobile production and bludgeoning is called for to enforce new trade sanctions. As the United States threatens trade sanctions on Iran, or Russia, or whomever, the Administration will bludgeon any nation pursuing an independent path of commerce with the sanctioned country by withholding access to the current “coin of the realm”.

Our long-time allies now join former adversaries in understanding the power of the US Dollar and they find the feeling uncomfortable. To Europeans it smacks of the threat Russian natural gas suppliers held over the European Union in 2008 when Russia made it clear they could cut off supply if the Europeans took too strong a position on Ukraine. Russia’s brinkmanship pushed Europe to look elsewhere for supply, including American LNG imports.

American bludgeoning has picked up momentum and the world is well aware of the weaponization of the currency. Worth noting is the International Monetary Fund’s declaration of the Chinese Renminbi as a Reserve Currency in October 2016. The Renminbi is far from any position to dethrone the Dollar today but may become troublesome tomorrow.

Come and listen to my story about a man named Xi….

China is already arranging oil purchases in Renminbi and local-currency Chinese oil futures contracts began trading in Shanghai in March of this year. Oil has always been a US Dollar denominated commodity but China has decided that it sees no reason that situation can’t change and as the bludgeon lands its blows, many countries might also reconsider the US Dollar as the Reserve Currency of choice. Movement to abandon the greenback is not a situation the United States relishes—particularly as ballooning deficits make Treasury sales at attractive rates more and more crucial.

Rival reserve currencies would also adversely impact the commodity futures traders who make markets in many key US commodities—soybeans anyone? China is the world’s biggest buyer of oil and, as noted above, now trades oil futures in their own currency.

As shown in the chart above, China’s oil trading activity is growing rapidly but has a long way to catch up and with the Renminbi still highly controlled by the government, it will be years before such Chinese contracts threaten Brent crude in London and West Texas Intermediate in New York. But as the world awakens to a Reserve Currency being used against their sovereign interests they will react…..Bitcoin anyone?

XTP

For investors today, the Dollar plays a role once again. Emerging markets are coming under pressure as geopolitical events test the fragility that is inherent with these investments. Argentina, Brazil, Turkey and some eastern European countries are all facing strains from political events. The Federal Reserve’s current move toward normalization of interest rates and the curtailment of Quantitative Easing’s bond purchases has caused a Dollar liquidity drain, as has the increased sale of US Treasury paper to fund tax cuts. None of this helps emerging markets dependent on Dollar transactions.

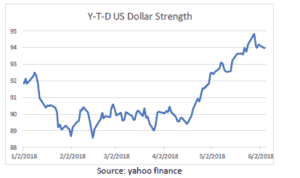

As shown below, the Dollar has significantly strengthened versus a basket of foreign currencies in the past few months. The strengthening Dollar will be painful, particularly for emerging countries, large US firms whose revenues rely on significant exports, and European investments in the US.

We would curtail heavy new allocations into equity markets at this point as we exercise XTP caution. XTP is not an innovative fuel additive or a new motocross bike, but Xi, Trump & Putin. These larger-than-life global leaders are sucking oxygen from the room as they exercise enormous influence over a changing landscape globally.

Trade wars, shooting wars and culture wars are raging and we are quite happy to duck for cover by holding existing positions in place.

E.B. “Chip” Beard

June 1, 2018